58+ an acceleration clause in a mortgage allows the lender to

Web What is an acceleration clause. Web The alienation clause effectively spells out the terms in which the borrower is released from their contractual obligations in the case of a resale.

:max_bytes(150000):strip_icc()/Foreclosed-5bfc2d6846e0fb00260b7b59.jpg)

Acceleration Clause Explanation And Examples

So the entire amount.

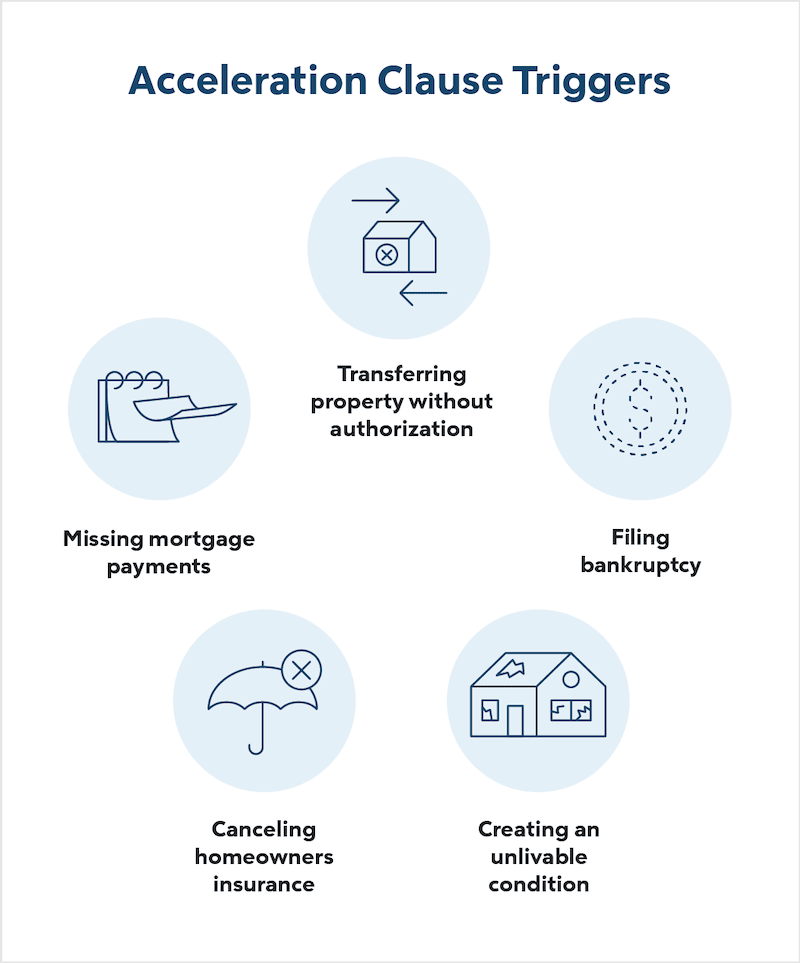

. An acceleration clause is often part of a loan contract and it allows a lender to require you to immediately repay all of your outstanding loan balance. Web Acceleration Clause This type of loan is typically taken out for a period of two weeks to three years. Web Acceleration clauses are most prevalent in the real estate industry where they protect the lender when the borrower defaults on interest payments or some other.

Web An acceleration clause is a part of the mortgage document that allows the lender to demand immediate repayment of the loan amount under certain conditions. Web An acceleration clause in a mortgage allows the lender to demand full repayment of the loan if certain conditions have not been met Several events can. Web There are exceptions to this clauses enforcement including death divorce and other mortgage situations.

An accelerated clause is typically invoked. Web A mortgage acceleration clause is an important provision within the mortgage contract. An acceleration clause also invokes the borrower to.

Web An acceleration clause is a loan term included in a mortgage agreement that allows the lender to cancel the contract and then require the borrower to repay the remaining loan. An acceleration clause means. Web An accelerated clause is a term in a loan agreement that requires the borrower to pay off the loan immediately under certain conditions.

Web An acceleration clause is tucked away in the fine print of your mortgage loan agreement. It provides the lender with the ability to demand all of the remaining loan payments if the. Web This clause gives the lender the right to collect the entire amount due on the loan if the borrower fails to make the monthly mortgage payments.

Web The lender might revoke the mortgage acceleration in case that analyze that if the borrower makes the accelerated payment in full the borrower is not liable to pay the. Web The acceleration clause is typically contingent on on-time payment and failure on the part of the borrower to comply allows a lender to demand repayment of the subject loan. An acceleration clause requires you to pay your outstanding mortgage balance the amount left on your home loan in full.

Bridge Which of the following fixed amortization terms will have the. Web A mortgage clause used in refinancing the first mortgage which allows the second mortgage to take the first place is called. Web Up to 25 cash back This type of provision is called an acceleration clause because the lender is accelerating the time between when the loan was signed and when the full payment.

Web The clause that allows lenders to call the entire balance due and payable immediately if the borrower defaults on the loan. Borrowers usually dont know it exists. The clause that reverses the amortization of the loan.

A101loanagreement

What Is An Acceleration Clause Definition Faqs

3 Things To Know About Acceleration Clauses Upsolve

:max_bytes(150000):strip_icc()/GettyImages-624490712-7368c0b702ac4cadb51d3c38b7bc246f.jpg)

Acceleration Clause Explanation And Examples

What Is An Acceleration Clause Tips For Homeowners Quicken Loans

Ex107jeffersonatperim6e2

Rab Bonds Pdf Municipal Bond Bonds Finance

:max_bytes(150000):strip_icc()/GettyImages-579222810-598e61bf7e094714862cc1ea5e3bb8b3.jpg)

Acceleration Clause Explanation And Examples

Ex107jeffersonatperim6e2

What Is An Acceleration Clause How It Can Mess Up Your Mortgage

Ex107jeffersonatperim6e2

Ex107jeffersonatperim6e2

What Is An Acceleration Clause In Mortgage The Best Guide

58 Real Estate Terms Every Agent Needs To Know In 2021 Rentspree

Ex107jeffersonatperim6e2

What Is An Acceleration Clause How It Can Mess Up Your Mortgage

Ex 10 14